How did OKbase handle the digitization of additional sickness insurance benefits?

In the OKbase team, we have prepared a new records feature for our customers that will help them comply with the newly mandated procedures. We will continue to work on further improvements.

As of January 1, OČR and all other sickness insurance benefits must be handled exclusively in electronic form

Caregiving allowance, long-term caregiving allowance, and other sickness insurance benefits should be issued solely in electronic form by physicians beginning in early 2025. In certain cases, patients will leave the doctor’s office with a so-called “identifier”, which they will then need to provide to their employer.

To make things easier for payroll accountants—who are now handling a significant portion of this administrative workload—and to allow them to keep the information flow between themselves, employees, and the state as digital as possible, we have added a new module in OKbase for recording these employee notifications.

We do not want them to have to resort to emails or text messages when they are already accustomed to managing as many tasks as possible directly in OKbase.

accountant’s side – in the rich client

How can an employee notify their employer about, for example, a caregiving allowance in 2025 using OKbase?

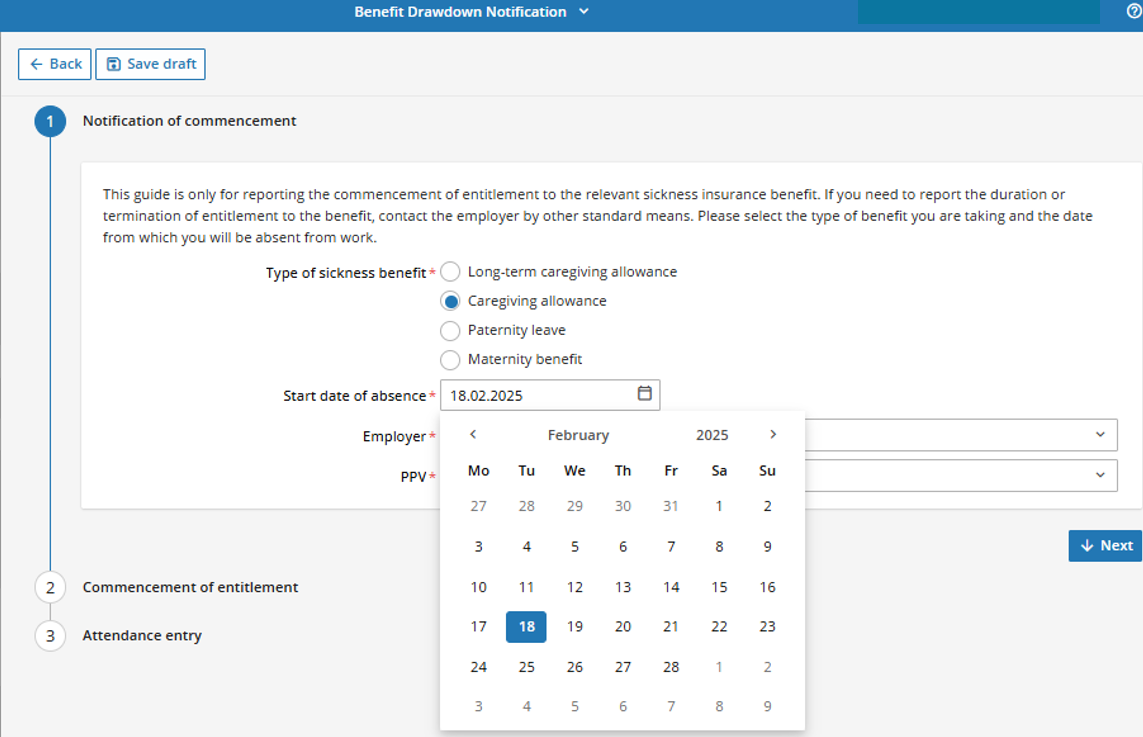

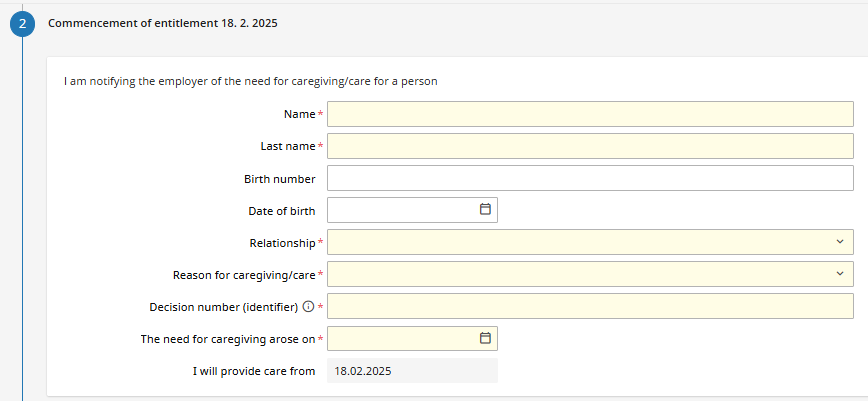

- In the web client, employees have a new option in the Payroll Documents section called “Notification of Commencement”. There, they can submit a new eBenefit request or review any previously submitted eBenefits. We will continue to develop this feature, but it already helps with record-keeping.

- The employee adds a New Record, selects the type of benefit, and the system then guides them through a form that differs for each benefit type. There are also checks on the information entered and on-screen help available.

- An HR specialist or a payroll accountant can assist the employee with the request; it can also be entered on the employee's behalf in the rich client.

What does the employer need to do first?

1. System Administrator: Grant employees and payroll accountants the appropriate permissions.

2. System Administrator: Configure the required settings to enable submitting new reports directly to the ePortal of the Czech Social Security Administration (ČSSZ).

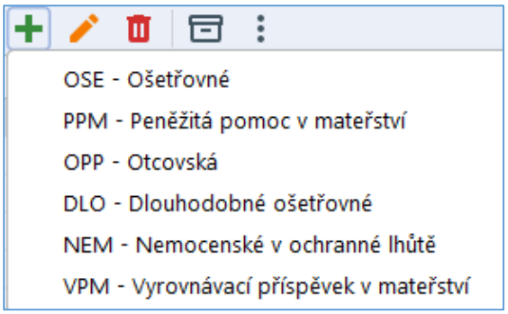

3. Payroll Accountants: Learn how to work with eBenefits and understand what needs to be filled out for each type of application:

- Caregiving allowance

- Long-term caregiving allowance

- Paternity leave

- Maternity equalization benefit

- Maternity benefit

- Sickness benefit during the protective period

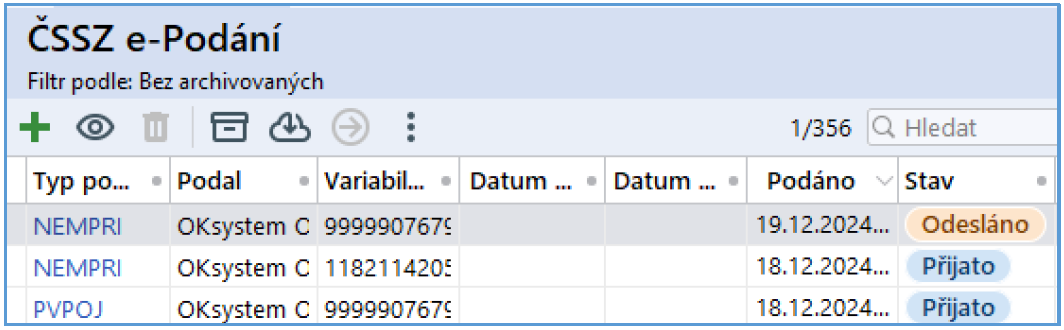

For electronic communication with the Czech Social Security Administration (ČSSZ) regarding these additional sickness insurance benefits, no new communication channel was created. Instead, the existing NEMPRI report was expanded.

For each submitted report, you must download the processing results, and if there is an error, correct it and repeat the process.

Review the Comprehensive eBenefits Guide

On January 2, we released and distributed a detailed eBenefits document that summarizes the latest updates regarding the new electronic benefits, including detailed explanations of how everything works, what you need to do, and practical examples. We believe it will be especially helpful for payroll accountants in the first few months.

Tips from the eBenefits Document – What Not to Forget

- For the paternity benefit, you must always export both the start and end simultaneously.

- A payroll accountant can delete the “Benefit Drawdawn Notification” in the rich client, effectively canceling the process. The notice is not removed from the employee’s view; it is merely flagged as not to be submitted. The payroll accountant can add a note explaining why the employee is not entitled to the benefit, etc. An employee can delete their own notification as long as it has not yet been submitted. Once submitted, it can no longer be deleted.

- Benefit information can still be corrected after submission. In such cases, a corrective report can be sent.

FAQ about eBenefits in OKbase

Here are a few recurring customer inquiries along with answers from our support team (we also include them in the Information for Version 6.13.2 document from last week):

Question: Will employees be able to report not only the start date in the online notification but, for example, in the case of caregiving allowance, also the exact usage period and when they finished using it?

Answer: This feature is not currently available, but we plan to expand the online notification to include reporting the duration or end of benefit usage. This option will be implemented in one of the future versions, and you will be informed in the release notes for the new version, likely 6.15.1 (June 2025).

Please note that for caregiving allowance, you only report the end of the support period. If the carer’s allowance lasts longer than 9 (16) days, its duration should be reported on the 9th (16th) day, and no further end date is reported.

Question: Are you planning a data transfer from eBenefits to the employee’s absence record—similar to how eSick notes are transferred to the employee in billing?

Answer: We do not plan to introduce such a transfer. The eBenefits module cannot be compared to the eSick Notes module. In eBenefits, we often record only the start of the benefit entitlement (but not its end). For example, with caregiving allowance, only the period during which the sickness insurance benefit (the support period) is drawn is recorded, not the entire duration of the employee’s absence from work.

We recommend continuing to enter payroll items into the Allowances and Absences record, as you have done so far.

Question: When filling out the form online, could family members already entered in OKbase be offered as a selection?

Answer: Yes, this should be possible in the future. This option will be implemented in one of the upcoming versions, and you will be informed in the release notes for that version—likely 6.14.1 (April 2025).

Question: Is it possible to send notifications to the Czech Social Security Administration (ČSSZ) directly from OKbase?

Answer: Yes, it is. You need to have the ČSSZ eSubmissions (ePodání) module enabled. If you do not have this module, please contact our support team.

Question: I’ve sent the eBenefit notice (NEMPRI25). Do I still need to send the attachment to the benefit application (NEMPRI)?

Answer: As of 2025, only the Employer’s Notice of Benefit Application is submitted for eBenefits. This notice already contains all the information from the attachment. The attachment to the benefit application is therefore not submitted separately.

Question: How should I fill in the end date and the employee’s return-to-work date for the paternity benefit so that the checks by the Czech Social Security Administration (ČSSZ) pass without errors?

Answer from the ČSSZ website: “The date on which the employee resumes work is optional and should only be entered if the employee returned on the last day of the benefit support period—i.e., day 14 for paternity benefit. For example, if the employee started paternity leave on January 1, 2025, and returned to work on January 14, 2025, the employer should enter this date and also the number of hours worked (e.g., 4 hours out of an 8-hour workday). If the employee returned to work on January 15, 2025, or later (or if the employment ended), the resumption date is not entered. Note: If, in the HR software, this field is set as mandatory, then the employer could, for instance, indicate a return to work on January 15, 2025, with the employee working 8 hours out of an 8-hour workday.”

Unfortunately, as of today, there are no general guidelines for completing the notice of benefit application. The Czech Social Security Administration (ČSSZ) is preparing them, and they will likely be published here: https://eportal.cssz.cz/web/portal/-/tiskopisy/nempri-2025.

For verification, addition, or submission of your filing, you can upload the generated XML file to the ČSSZ ePortal.

Doctor issued a caregiving allowance (OČR) in paper form...?

According to the information on the ČSSZ website, there is a temporary allowance for benefits to be issued in paper form in certain cases. For more details, see the following article (in Czech):

ČSSZ připravila digitalizaci všech ostatních dávek nemocenského pojištění ke spuštění od 1. 1. 2025.

Back